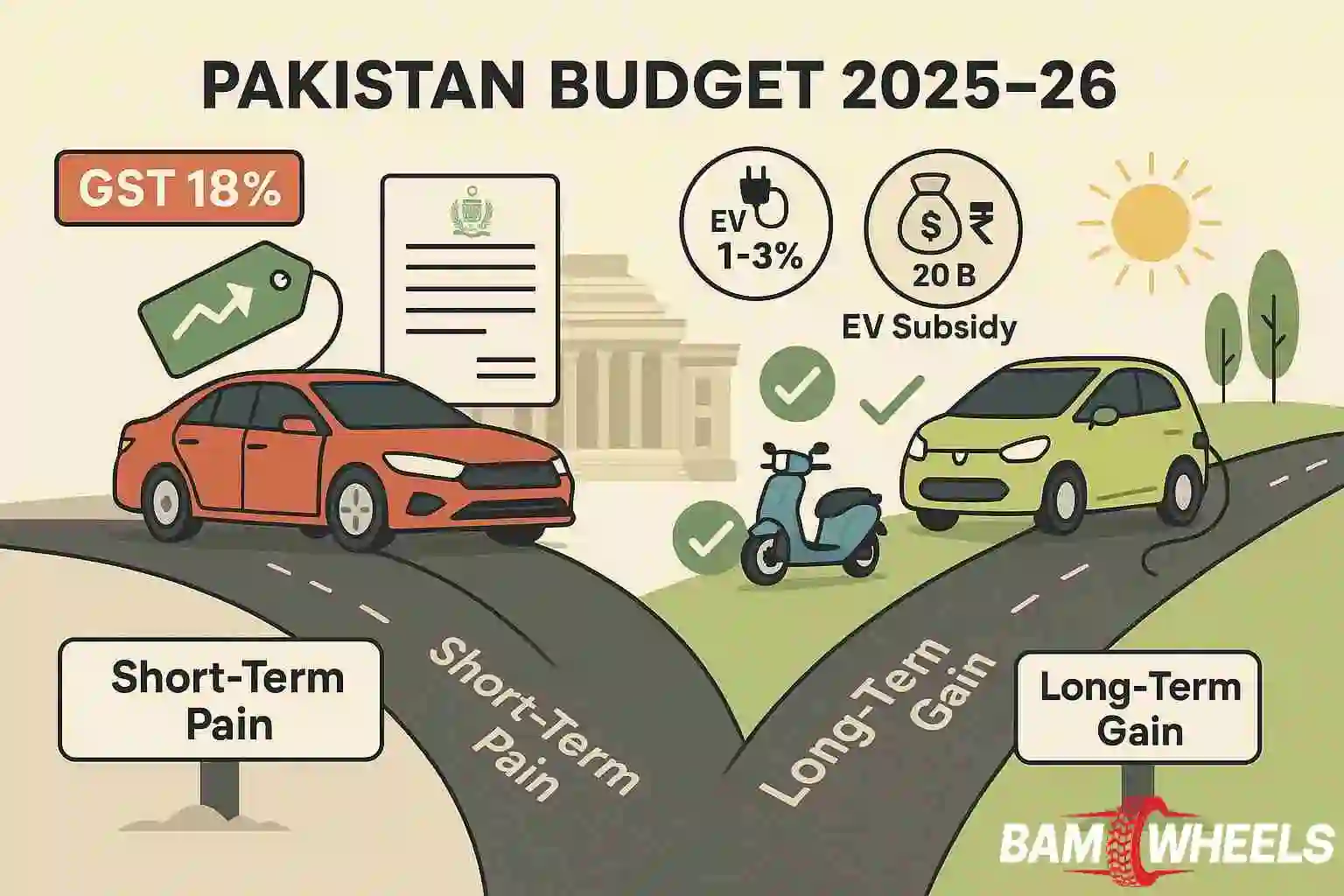

The 2025–26 federal budget introduces sweeping changes for Pakistan’s automotive sector, bringing both immediate challenges and long-term opportunities.

In the short term, vehicle prices are set to rise significantly. The government has withdrawn GST concessions on small cars (≤850cc) and hybrid vehicles, applying the full 18% sales tax instead. Additionally, a new “EV adoption levy”—ranging from 1% to 3% based on engine size—will apply to all petrol and diesel vehicles, both locally manufactured and imported. These taxes will make new vehicles more expensive and could push consumers toward used or smaller alternatives.

Electric vehicles (EVs), especially two-wheelers, will see increased policy support, with ₨20 billion allocated for EV subsidies. The levy on ICE vehicles will fund a new Electric Vehicle Fund, setting the stage for a cleaner future, even if the EV impact remains limited in the short term.

For local assemblers, input costs are stable for now—no new duties on CKD kits or parts—but rising end-prices and suppressed demand may affect production volumes. Meanwhile, a long-term plan to reduce import duties and ease used car policies hints at a more open and competitive auto market ahead.

The macro picture—lower inflation, projected GDP growth, and a stable rupee—supports cautious optimism. But for now, buyers and automakers alike face a tight fiscal environment.

Who Wins and Who Pays in the New Auto Budget?

With vehicle prices climbing, the 2025–26 budget places the biggest burden on consumers. Small and hybrid car buyers now face 18% GST, while all petrol and diesel vehicles come with a 1–3% “EV adoption levy”. Combined with a new carbon levy on fuel, the total cost of ownership is rising. Financing remains tough—especially for first-time buyers—until interest rates ease.

For manufacturers, the outlook is challenging in the short term. Higher prices mean slower demand, and there’s no tax relief to soften the blow. However, the long-term reduction in import duties and planned EV fund open doors for local electric vehicle production.

Importers, especially of fully built cars, are also squeezed by the new levy. But reforms in used car policy and gradual tariff cuts hint at future growth opportunities.

Stay tuned tomorrow for a deep dive into segment-wise impacts, import/export policies, EV strategies, and long-term implications for manufacturers and consumers.